Readers of my blog at the former location may remember that I covered this subject in a previous post… somehow that post did not get converted to the new location of the blog on this website, so I am re-addressing the subject here. Thus, most of the content is from the post on the previous site, with some minor revisions.

CIPM candidates must know what return calculations are required by the Global Investment Performance Standards (GIPS), and in which circumstances.

Most of the time, time-weighted return (TWR) is required, but in some cases a since inception internal rate of return (SI-IRR) must be used.

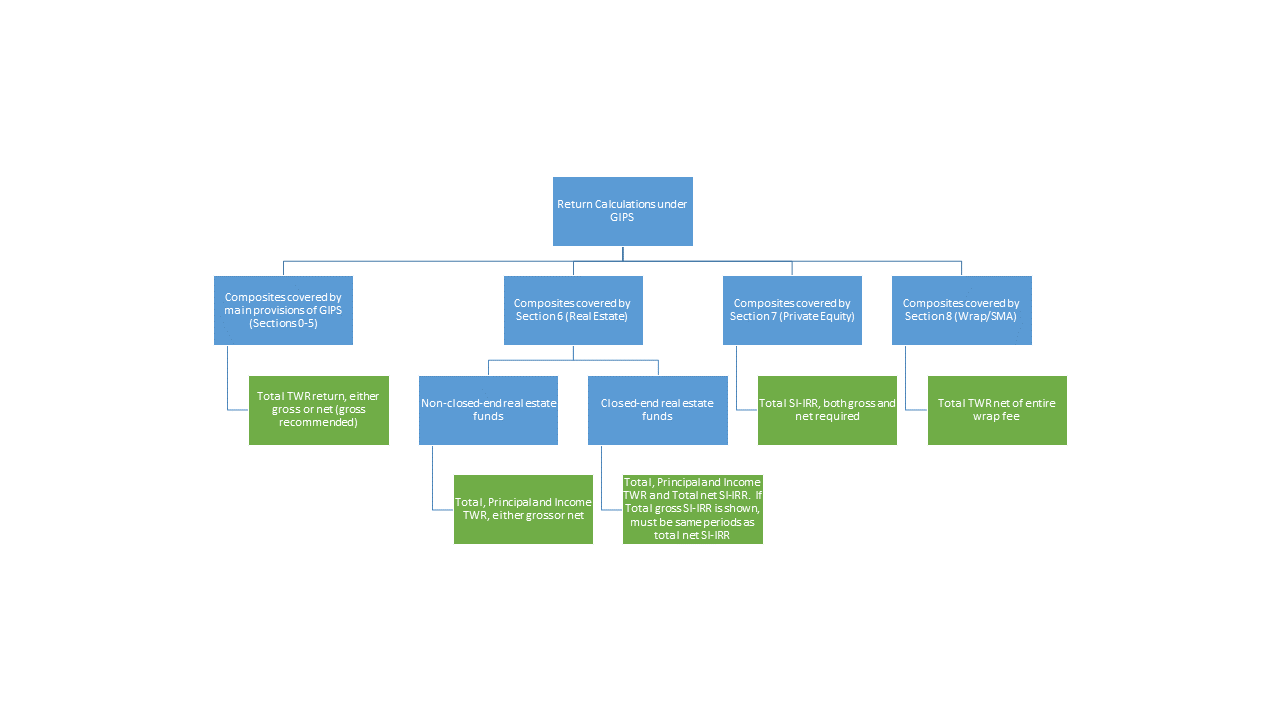

But what are the specifics? The following graphic gives a hierarchical view of the requirements, and the text that follows cites the specific provisions.

Here are the details, from a provisions standpoint:

- Generally speaking, i.e., if the real estate provisions of GIPS and the private equity provisions of GIPS do not apply (sections I.6 and I.7, respectively), then time-weighted returns are required by GIPS provision I.2.A.2.

- Total returns (i.e., that include gain/loss and income/expense) must be used (provision I.2.A.1).

- Either gross-of-fees or net-of-fees may be used, as long as clearly labelled (provision I.5.A.1.b).

- Gross is recommended (provision I.5.B.1).

- If the wrap/SMA provisions of GIPS (section I.8) apply, then returns must be net of the entire wrap fee (provision I.8.A.6).

- If the private equity provisions of GIPS (section I.7) apply, then since-inception internal rate of return is required (provision I.7.A.3).

- Total returns (i.e., that include gain/loss and income/expense) must be used (provision I.2.A.1).

- Both gross-of-fees and net-of-fees must be presented (provision I.7.A.21).

- If the real estate provisions of GIPS apply (section I.6), then time-weighted returns are required (provision I.2.A.2).

- In addition to total returns (which reflect gain/loss and income/expense) required by provision I.2.A.1), component returns must be presented (provision I.6.A.9). Component returns are the capital return (gain/loss) and the income return (income/expense).

- Either gross-of-fees or net-of-fees may be used, as long as clearly labelled (provision I.6.A.14).

- If the composite in question is a closed-end real estate composite, then both time-weighted returns and since inception internal rates of return must be presented.

- For closed-end real estate composites, with respect to time-weighted returns, the general requirements for real-estate composites must be met; i.e., calculation of total return, capital return and income return, which may be shown either gross- or net-of-fees (provisions I.2.A.2, I.2.A.1, I.6.A.9 and I.6.A.14).

- Firms must present the net-of-fees since-inception internal rate of return (provision I.6.A.23).

- If the firm shows gross-of-fees since inception internal rate of return, it must be shown for the same periods ;for which the net-of-fees SI-IRR is presented.

So, as you can see, it can become a bit involved when trying to determine whether to use TWR or SI-IRR, what is required vs. what is recommended, and is it a net- or gross-of-fees return that should or must be used. The above bullets (and accompanying hierarchical chart) should spell out all of the scenarios and help you know when each type of return is required.

Happy studying!