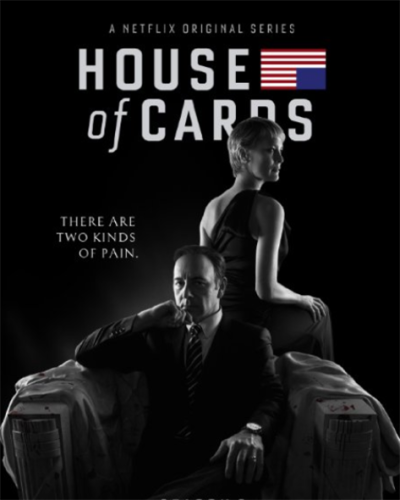

“Of all the things I hold in high regard, rules are not one of them. ”

Francis (Frank) Underwood

Our son, Chris, gave us a device for our television that allows us to watch Netflix, as well as other Internet based programs. Several folks had recommended “House of Cards” to me (they were right), and my wife and I binge watched the first two seasons during the holiday break. Frank Underwood, the main character, reminds me a bit of J.R. Ewing (from the TV show, “Dallas”), one of my “heroes” from the past (it would take awhile to explain myself, so I won’t, at least now).

I was struck by the above quote, and recorded it for future use, which happens to be now!

Rules … whose are they?

WHO likes rules, anyway? We have rules such as:

- don’t split infinitives*

- clean (i.e., eat everything on) your plate (probably one reason I need to lose some pounds … it’s (once again) on my list of New Year’s resolutions)

- respect your elders (as an elder, I am a fan of this one)

- and on and on and on some more.

As for who likes them, folks that need them or want them to provide guidance. Sometimes, we have conflicts in the rules: HSBC has done a great job with various advertisements, showing some of these as we go around the world.

When I was 13, my mother died and I moved in with my aunt, her sister. Until that moment, she was a favorite of mine; but, once under her roof, the affection faded. She had loads of rules, most of which I objected to. One was that I couldn’t wear loafers (“loafers are for loafing”). In the 1960s, “penny loafers” were quite popular; I couldn’t own them, even if I paid for them myself. Suffice it to say, after I left her household, I purchased a pairs of loafers, and have owned several pair over the past four-plus decades.

The reality is that anyone can make up rules, but we generally like it when they come from an organization with some standing in the industry.

Performance measurement rules

The investment industry’s use of rules to calculate returns dates back to 1968, when the (USA-based) Bank Administration Institute (BAI) published a set of rules for pension fund returns (they appear to have introduced the term “time-weighting,” as well as the “exact” method to derive returns). That “standard” became quite popular, as many institutions claimed they complied with the “BAI rules” at one time. Today, of course, it’s GIPS(R) (Global Investment Performance Standards).

These rules are handy, as they serve as a “benchmark” for many when calculating and reporting performance to prospects. And although they’re not technically “calculation standards,” they do have rules regarding acceptable ways to measure performance, and serve as the de facto standard here, too. For the most part, we agree with what’s included; and as for those areas where we differ, there’s not much need to discuss them, because one will always have differences, right? Just as some folks drive on the right hand side of the road while others drive on the left (as long as you abide by the local rules, chances are you’ll be okay).

Making up our own return formulas (that don’t match the rules)

We often encounter firms who have adopted their own return method, that typically aren’t in alignment with common practice. I recall one time when the client was adamant that they had vetted the formula with their clients, and everyone agreed it was fine; well, that might have been the case, but it was a method that made lots of sense, but was invalid.

Recently, I discovered a firm that treated most of their cash flows as end-of-month events: recognize that we often engage in lengthy discussions on end-of-day vs. start-of-day, but end-of-month? I was the bearer of bad news: that it’s invalid. To make matters worse (?), their documentation didn’t disclose this fine point, which might have met with objections from their more savvy clients.

Without rules, we have the potential for “anything goes,” as Peter Dietz discovered when he surveyed the pension fund industry in the 1960s, as part of his doctoral dissertation research. And in the 1980s, we discovered that in the absence of rules, some investment firms were using quite a bit of creativity in the way they promoted their past performance. Thus, the emergence of the Financial Analysts Federation’s initiative to develop rules for performance presentation, which begot the AIMR-PPS(R), and arguably GIPS. And, as a result, we’re a whole lot better off.

Like Francis, we may not like rules, but they’re usually a good thing to have, especially when it comes to performance measurement.

Note: * For grammar rules, I frequently turn to “Grammar Girl,” and for this, she had a few things to say.