While Mark Twain might not have been totally correct, his comment no doubt applies to many folks and/or situations.

But as for me, I think changes in performance measurement are generally welcome, as they mean improvements in what we do.

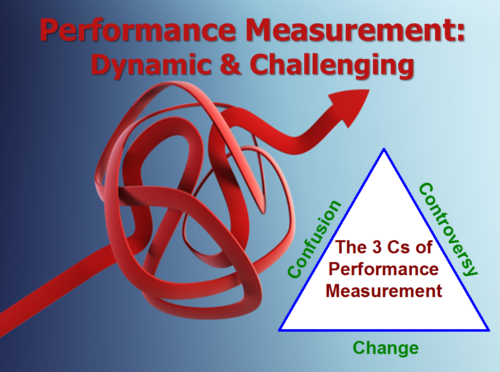

The 3 Cs of Performance Measurement, including changes in performance measurement

In our recent one-day webinar on rates of return, I included the following slide:

I coined the “3 Cs” more than a decade ago (actually, close to two), and “change” has been an integral part since then.

Should we not welcome these changes? Should we not embrace these changes? Should we not encourage these changes?

One of the things I love about our profession are the dynamics that are so prevelant. As I told the class,

- we don’t have all the answers

- we are frequently rethinking what we’re doing

- we’re finding better approaches.

And, the investment industry itself is dynamic, and so, performance measurement must be able to respond.

Changes in performance measurement occur regularly

There was a time, not too long ago, that the Global Investment Performance Standards (GIPS(R)) had changes every five years, but that has apparently been put on hold. However, we often see new guidance statements introduced, as well as Q&As published.

I’ve frequently challenged some of the ways we do things, as have many others. The Journal of Performance Measurement(R) has been the source of numerous changes over its 20 year history.

I fully understand that in many aspects of our lives, we don’t like change. However, this has changed, too (sorry for the less than mellifluent wording).

In 1988 I attended a workshop sponsored by the Investment Council Association of America (ICAA), now the Investment Advisers Association, titled “Accuracy vs. Cost in Performance Measurement.” It caused many of us to reconsider how we were calculating returns. Back then, it wasn’t uncommon for portfolios to be valued only twice a year, and then to run the Original (mid-point) Dietz method to get a rate of return. Some firms did the calculations quarterly, and of course, many did it monthly, and occasionally with Modified Dietz. Today, it’s becoming quite common for firms to use the exact method, revaluing their portfolios whenever a cash flow occurs. The result: increased accuracy.

I, along with Steve Campisi, CFA and Stefan Illmer, PhD have been championing the use of the internal rate of return for some time, and have been meeting with great success of late. This means changes in how folks are both calculating and reporting performance.

Embrace change!

I hope you agree with me, that

Oh, and for our ROR webinar class, we’ll be hosting it again on September 14th. To learn more, please contact Patrick Fowler (PFowler@tsgperformance.com).