by admin | Oct 4, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, performance appraisal, performance measurement, performance reporting, performance triangle, rate of return, TSG

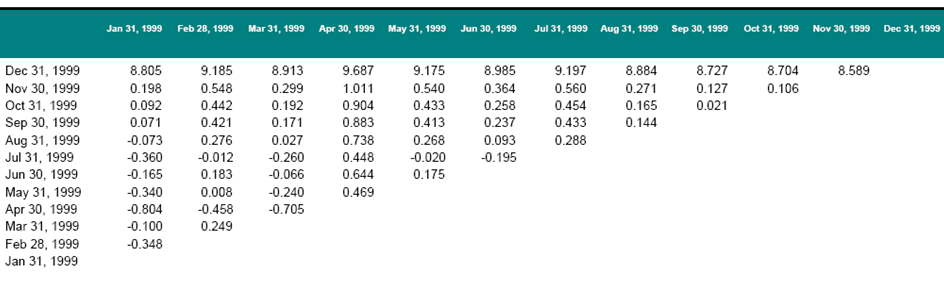

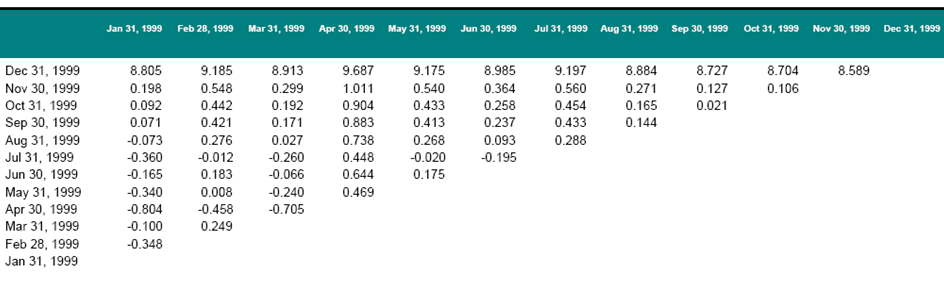

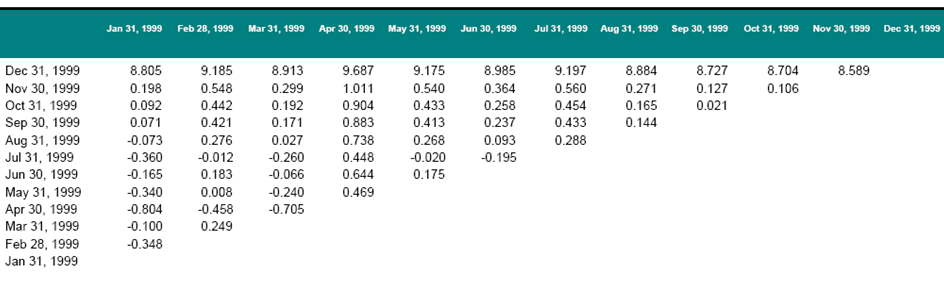

At the CIPM Expert Level, the topic of “performance triangles” is covered, and there is one specific Learning Outcome Statement on the subject:Demonstrate the use of performance triangles vs. benchmarks in assessing a manager’s track record Having...

by admin | Oct 3, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, estimated time-weighted return, internal rate of return, IRR, Modified Dietz, performance measurement, return measurement, true time-weighted return, TSG

In my last post, I covered a “fast” way to solve multiple choice internal rate of return exercises. In today’s post, I look at a second quick method.Recall the details from the last post:Account market value on 3/31 is $56.3 millionAccount...

by admin | Oct 1, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM Principles, internal rate of return, IRR, performance measurement, private equity, rate of return, real estate, return measurement, SI-IRR, TSG

I have covered the steps to calculating internal rate of return in a few different posts on the blog, including here, here and here. I have also covered the steps to use the cash flow worksheets of the TI BA II Plus and the HP 12 C. You may have read the...

by admin | Sep 22, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM Principles, leveraged return, levered return, performance measurement, rate of return, return contribution, return measurement, use of leverage

Yesterday, I covered return calculation for a portfolio with leverage. To review, the background information is:The investor wants to acquire a 500 million euro property but only has 400 million in cashThe investor borrows 100 million euro in order to acquire...

by admin | Sep 21, 2013 | cash basis return, CIPM, CIPM Exam Tips & Tricks, CIPM Principles, GIPS, levered return, margin return, rate of return, real estate, return measurement, time-weighted return, use of leverage

Leverage can be a confusing topic, so I figured it is worth covering in a few blog posts. In this first post, we’ll deal with return calculations for portfolios that employ leverage.Leverage is the use of borrowing, typically with an intent to amplify...

by admin | Sep 20, 2013 | CIPM, CIPM Exam Tips & Tricks, CIPM expert, CIPM formulae, CIPM formulas, CIPM Principles, estimated time-weighted return, Modified Dietz, Original Dietz, return measurement, time-weighted return, true time-weighted return, TWR

For today’s post, I’d like to review some of the “Dietz-style” formulae we use to calculate true time-weighted return and estimated time-weighted return. I’ve never actually seen the formulae presented this way, but hopefully doing...