Chapter

2

The GIPS Standards for Asset Owners

MAJOR CHANGES FOR ASSET OWNERS

We’ve identified three of the changes to the Standards as being worthy of being classified as “major.” The many remaining changes may not be “major,” but are still important, and are delineated below.

Recall that any change identified with a red asterisk below reflects ones that cannot be adopted without adopting the full set of changes.

1. Options expanded for defining the firm for GIPS purposes.*

Some organizations act as an asset owner, where they are managing assets on behalf of participants, beneficiaries, or the organization itself, but there is also a segment of the organization that acts like a firm that has prospective clients and competes for business.

Originally, it was proposed that if there was a segment of an asset owner organization that can compete for business, that part of the asset owner organization must be defined as a separate firm for the purpose of complying with the GIPS standards. This would require an organization to split up the assets so that all assets managed on behalf of the asset owner would be included in an entity defined as an asset owner that complies with the GIPS Standards for Asset Owners, while assets managed and presented to prospective clients are included in a separate firm that complies with the GIPS Standards for Firms.

However, based on feedback from the industry, the final guidance was updated to include three options for these entities that act as both an asset owner and a firm:

∙ Divide the asset owner into two distinct, defined firms for the purpose of complying with GIPS: one defined as an asset owner and one that is defined as a firm.

∙ Define the entity as a single firm that complies with the GIPS Standards for Firms.

∙ Define the entity as a single, GIPS-defined firm that is both an asset owner and a firm and follow the relevant GIPS standards for each.

For an asset owner that selects the first option, this would effectively mean the organization would follow the original proposed guidance where there are two distinct, defined firms for the purpose of complying with GIPS, one that follows the GIPS Standards for Asset Owners and another that follows the GIPS Standards for Firms.

If an asset owner decides to adopt the second option, it would define one entity with all assets included in that entity, but that entity would comply with the GIPS Standards for Firms when reporting performance to both the oversight body and prospective clients when competing for business.

Finally, if an asset owner chooses the third option, it would define the entity as just one firm that includes all assets, but when competing for business, it complies with the GIPS Standards for Firms and when reporting to the oversight body, it complies with the GIPS Standards for Asset Owners.

2. Estimated Transaction Costs*

Within the 2010 GIPS standards, returns must be calculated after the deduction of actual trading expenses.

While the requirement for all returns to reflect the deduction of transaction costs has not changed, the 2020 version includes the major change of now allowing asset owners to use estimated transaction costs. The term “trading expenses” was changed to “transaction costs” in order to reflect the broader concept of all costs associated with acquiring and disposing of assets. Estimated transaction costs are allowed for those portfolios where actual transaction costs are unknown.53 The challenge: how to do this.

We detailed an approach in our February 2019 newsletter.54 We repeat a significant portion of that narrative here.

Estimating transaction costs comes in two parts

When planning to estimate transaction costs there are two things that must be addressed:

∙ What will the actual estimated transaction costs be?

∙ How do we implement it?

It would seem that the first issue might be difficult, but we don’t think so. Let’s take two different scenarios:

The manager has non-wrap fee accounts investing in same securities

In many cases, the manager who has wrap fee portfolios also has non-wrap, meaning portfolios that pay a single advisory fee and for whom transaction costs are part of each trade. In this case, the manager needs to review what these costs are and use them for the wrap fee.

The complexity comes in if the costs can vary widely across different types of securities (e.g., small cap vs. large cap, domestic vs. non-domestic vs. emerging markets). As a result, a table may be necessary to derive the appropriate costs for each security traded.

53 ¶ 22.A.10, Global Investment Performance Standards, 2020.

54 See https://tsgperformance.com/wp-content/uploads/2019/02/NLFEB19.pdf

The manager only has wrap fee accounts investing in certain securities

If the manager doesn’t have non-wrap fee portfolios investing in some or all the securities that the wrap fee accounts are invested in, then they don’t have an internal benchmark to draw upon. Therefore, they will need to reach out to the brokers they’re dealing with and ask them what the transaction costs would have been had these trades been done for non-wrap accounts.

Again, these costs may vary by market, capitalization, etc., so a table may be needed.

Now that we have the transaction costs, how do we incorporate them into performance?

As noted above, we had promised to address this topic. In Dave Spaulding’s comment letter55 he fully supported this change. However, when he began to ponder it he wondered how it would be accomplished.

Transaction costs come into play with trades; and the Standards don’t explicitly deal with trades; rather, as you know we deal with starting and ending values and cash flows.

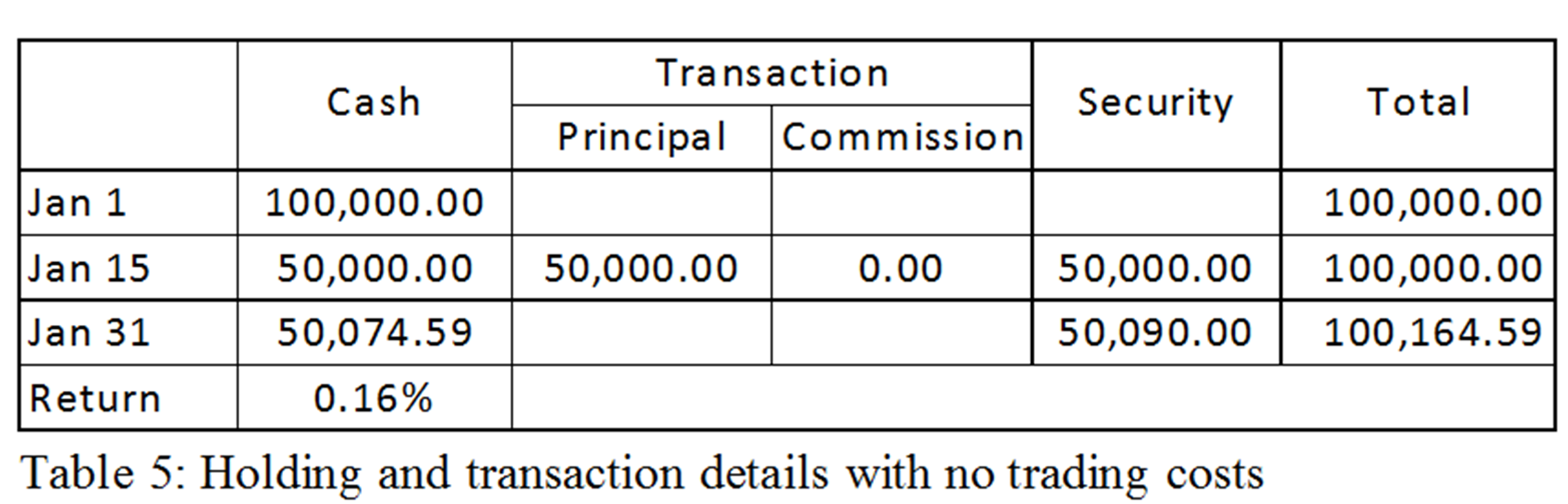

Let’s take a really simple example where we are not able to isolate the transaction costs:

∙ January 1: Account holds $100,000 in cash only

∙ January 15: Account spends $50,000 to purchase a security.

∙ January 31: The cash earns approximately 0.10% interest for the month while the security’s value has increased by approximately 0.18 percent.

Table 5 summarizes the data.

55 See

https://www.gipsstandards.org/standards/Documents/Guidance/gips_2020_exposure_draft_spaulding.pdf

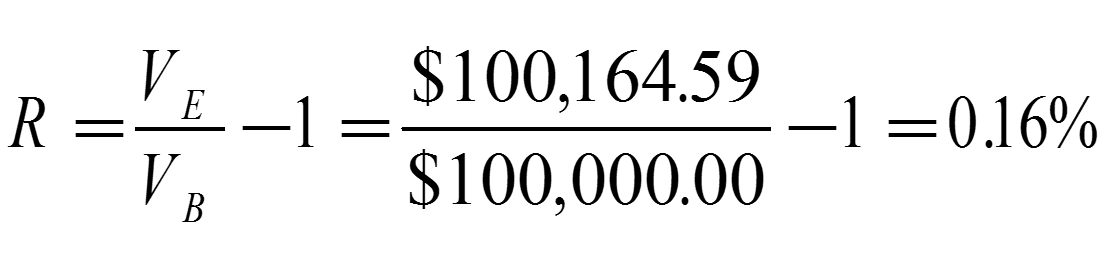

We calculate the return as:

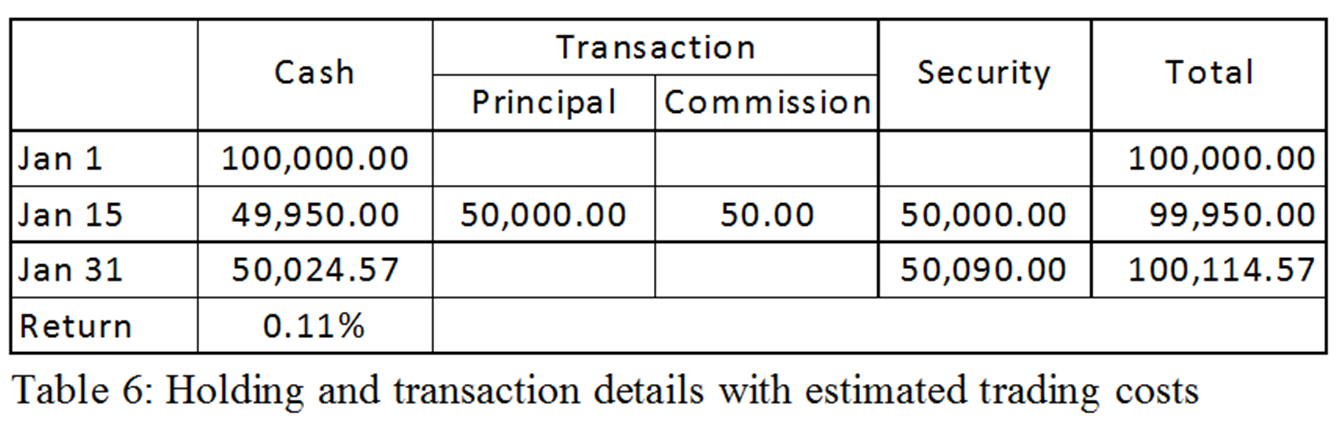

We now want to incorporate estimated transaction costs; in this case, the commission on the trade. We will assume that it’s 0.10% of the principal amount. The principal amount won’t change. However, we will need to reduce the cash amount by the commission. The result is shown in Table 6.

The security’s value increased the same as in Table 5, and the interest income percent for cash is the same, except that there was less cash in the account for the second part of the month. As a result, the ending portfolio value is lower and we see a corresponding drop of 0.05% in the monthly return.

The challenges

On the surface estimating transaction costs may sound like a pretty simple undertaking, once you know the amount. However, in reality it seems to be far from that.

We think there’s a temptation to come up with a fee, similar to the firm’s management fee. Some percent that would be used to adjust the return each month. However, while the advisory fees are typically based on amount of assets, transaction costs are based on the individual transactions that occur; and these can vary from number and size from one month to the next.

We are essentially wanting to adjust the cash amount to reflect the additional transaction costs. Any interest that is realized in the month is based on the amount of cash, and the party who is paying this interest doesn’t know or care whether there were commissions paid on the trades that were done. But we will want to adjust the cash somehow, so that the overall portfolio value will change.

A “simple” solution for monthly return methods

No large cash flows

We suggest that the process be a 4-step one. For each account, if a monthly return method is used:

Step 1: Inventory all trades done during the month and determine the estimated transaction costs for each one.

Step 2: Sum these costs to know the total estimated transaction costs for the month.

Step 3: Reduce the end-of-month cash amount by the estimated transaction costs.

Step 4: Use the adjusted cash value in the total value for the portfolio to derive the monthly return.

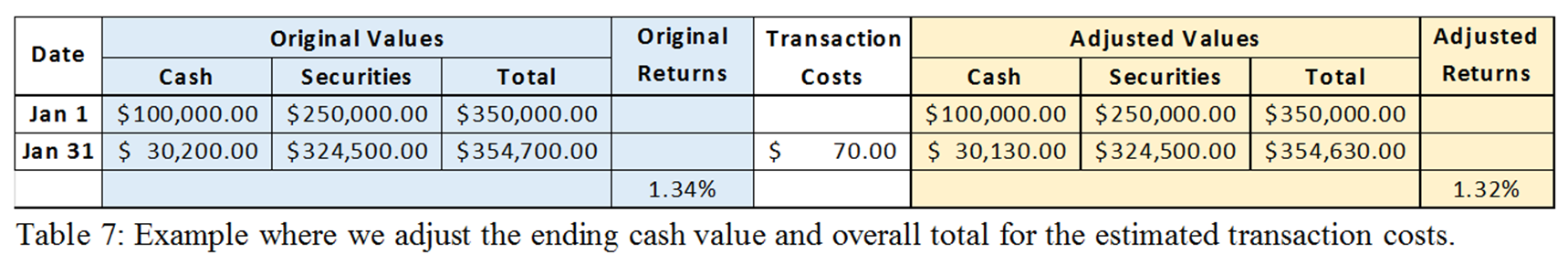

Table 7 provides an example.

We start the month with $350,000 and found that the total estimated transaction costs are $70. The “Original Values” reflect the case where no transaction costs were taken out; the “Adjusted Values” sees that we’ve reduced the cash amount, which results in a lower overall total portfolio value. The result is a 2 basis point drop in performance.

This approach is “simple,” because we are not worrying about the anticipated reduced interest on the now lower cash balance; this would likely be de minimis, and not worth worrying about.

It’s also “simple” because we are not taking into consideration the presence of “large cash flows,” which might make their way into the portfolio. It would arguably be incorrect to only adjust the end of the month values, if the presence of large flows resulted in intra-month returns to have occurred.

A large external cash flow occurs

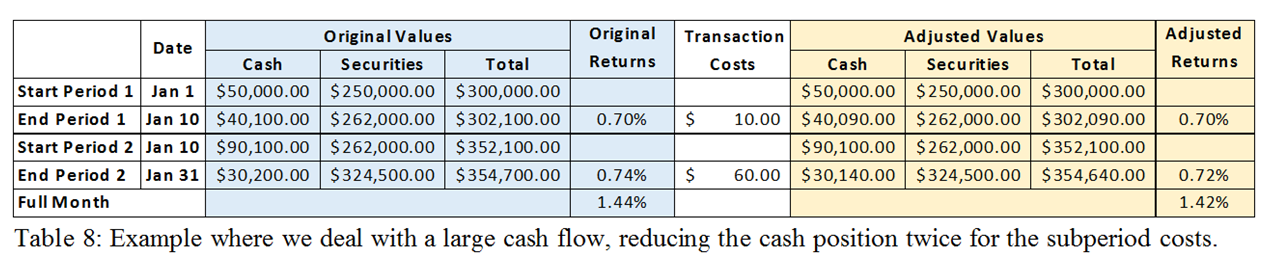

Consequently, if there are intra-month large flows resulting in more than one return for the month, then we need to adjust the ending cash value for each sub-period. This adjustment would result in an adjusted end-of-period cash amount. Consider the example in Table 8.

Here we see there was a single $50,000 (i.e., large) external cash flow on January 10. And so, we break the month into two parts.

We have to determine the transaction costs for each part of the month (from the 1st to the 10th, and then for the balance of the month). The “Original Values” section reflects the case where there are no transaction costs reflected; the “Adjusted Values” has the ending period cash and total positions reduced by the transaction costs. We see that as a result there’s a 0.2% drop in performance.

You’ll see that we did not adjust the starting period value for the second period. One might consider whether we should begin the second period with the adjusted ending values from the first period. Something perhaps to reflect upon.

A solution for daily return methods

If the firm is using daily performance, then each day they should derive the estimated transaction costs and adjust that day’s ending cash and total values by these amounts.

In summary

Incorporating estimated transaction costs into performance is not a trivial undertaking, but is probably worth the effort. In what we propose there are two main aspects that need to be dealt with:

∙ Arriving at the actual transaction cost estimates

∙ Applying the estimates.

Transaction cost estimates can be based on the actual costs that occurred for non-wrap fee portfolios. In the absence of such trades, they should be able to be obtained from the brokers who do the trades. It is likely that there will be multiple sets of estimates, depending on the markets the asset owner is investing in.

As for applying the estimates, the firm needs to determine these estimates through the month. In the simplest case, where a monthly method is used and there are no large external cash flows, these estimates can be reduced from the ending cash and total portfolio amounts. When a monthly return method is used and large flows occur, then the period has to be broken up, where the estimates are applied to the end of each of these periods. Finally, when a daily method is used, then these estimates are applied on a daily basis.

3. Valuation*

Within the 2020 version of the Standards, the private equity and real estate-specific provisions were removed. Additionally, a new term was introduced, “private market investments” to cover all assets that are illiquid, not publicly traded, and are not traded on an exchange.

In the 2020 draft, it was proposed that all private market investments would be required to have an external valuation, a valuation review, or a financial statement audit by an independent firm at least once every 12 months. However, based on feedback received during the public comment period, the final 2020 GIPS guidance does not include a requirement for an independent annual valuation for non-real estate private market investments. It is now a recommendation.

Real estate-specific independent valuation requirements are included in the final version of 2020 GIPS. Real estate is defined as investments in land, including products grown from the land, buildings, equity-oriented debt (such as participating mortgage loans), and private interest in a property for which some portion of the return at the time of the investment relates to the performance of the underlying real estate. It includes wholly or partially owned real estate.

Real estate investments directly owned by the asset owner must:

∙ Have an external valuation at least once every 12 months unless the oversight body stipulates otherwise, in which case real estate investments must have an external valuation at least once every 36 months or per oversight body instructions if the oversight body requires external valuations more frequently than every 36 months; or

∙ Be subject to an annual financial statement audit performed by an independent public accounting firm. The real estate investments must be accounted for at fair value and the most recent audited financial statements available must contain an unmodified opinion issued by an independent public accounting firm.56

These external valuations must be performed by a professionally designated or certified commercial property valuer or appraiser that is an independent third party. If these professionals are not available, the asset owner needs to take necessary steps to use qualified, independent property valuers or appraisers.

In terms of requirements for valuation frequency, in 2020, this depends on the type of return being presented and whether the portfolio is included in an additional composite.

For time-weighted returns, total funds and portfolios in composites, except private market investments, must be valued at least monthly, at the time of large cash flows, and as of the calendar month end or the last business day of the month. For private market investments included in composites, they must be valued at least quarterly.

56 ¶ 22.A.33

With respect to money-weighted returns, all portfolios in the composite must be valued annually or whenever returns are calculated.

NOT-SO MAJOR CHANGES

In addition to the aforementioned three “major” changes, there are a host of other important changes that need to be reviewed.

1. Creation & Inception Date

The exposure draft proposed eliminating the need to report a composite’s creation date, substituting inception date. We can understand this, as many, many firms found this to be confusing, often thinking the Standards meant inception date.

Well, the resulting version modifies what was proposed, and requires both the total fund’s or the composite’s inception date57 and the composite creation58 date to be reported.

2. Terminology changes

We no longer have “composite presentations,” but instead “GIPS Asset Owner reports.”

The term “linking” used to mean “mathematical linking” (i.e., geometric linking of returns) and “presentation linking” (that is, visually connecting information on a page). As to the latter, it was inappropriate to provide both hypothetical, back-tested results alongside of actual results.

The Standards are changing such that only the “mathematical linking” remains.

3. Trademark disclosure

Over the past several months, we have attempted to educate many in the industry about the CFA Institute’s increased desire to protect the GIPS registered trademark (i.e., the ®). We have done this primarily through a series of presentations on the 2020 version.

Something we didn’t know: such “marks” must be used as adjectives. And so, to state “we comply with GIPS” would be deemed inappropriate.

In addition to working on our writing and grammar, we are now obligated to make certain disclosures regarding the use of the mark. Several of our firm’s website’s pages, for example, now include the following disclosure: CFA Institute does not endorse, promote or warrant the accuracy or quality of TSG, Inc. GIPS® is a registered trademark owned by CFA Institute.

57 ¶ 24.C.10

58 ¶ 24.C.11

Well, such a disclosure is now required within GIPS reports: “GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.”59

4. Deadline for updating

The exposure draft proposed that asset owners be required to update within six months. We, as well as many others, agreed that a deadline was needed, but felt that six months was too tight. The GIPS Executive Committee agreed, and so asset owners must have their materials updated within 12 months of the most recent annual period. E.g., in August 2019, GIPS Asset Owners reports must be through at least December 2017.

5. Side pockets*

The 2020 version requires asset owners to include the effect of any side pockets held by the total fund, portfolios, or pooled funds in returns.

6. Non-GIPS compliant performance

Only GIPS-compliant performance is allowed to be presented in the GIPS Asset Owner report. Asset owners may link GIPS-compliant performance to non-GIPS compliant performance outside of the GIPS Asset Owner report.

7. Material Errors

Compliant asset owners who discover material errors will be required to provide the corrected materials to their verifier. In addition, if the correction covers a period(s) that was(were) handled by a different verifier, then that verifier must be sent the corrected material.

8. Distribution of reports

An asset owner must now “be able to demonstrate how it provided GIPS Asset Owner reports to the oversight body.”60 This will be something verifiers will be checking on, so it’s critical that this be done. The exposure draft had suggested verifiers would have to do some fairly strong due diligence here, which would have been quite challenging and cumbersome; fortunately, this didn’t make it through. But, we are still expected to do some testing.

59 ¶ 24.C.2

60 ¶ 21.A.14

So far, there isn’t much in terms of how an asset owner is to do this. Might a list of recipients suffice? Probably. We’d expect the asset owner’s policies and procedures to detail how they do this, and this would most likely be what the verifier will key off of.

9. Lists of total funds and composite descriptions

An asset owner must maintain a list of total fund descriptions and composite descriptions for any composite that has been presented in a GIPS Asset Owner report. An asset owner has always been required to maintain a list of composite descriptions. Similar to guidance for firms with pooled funds, the 2020 version of the GIPS standards states that asset owners may have both composites, where total funds of the same strategy are combined and presented to the oversight body as a single composite, or total funds that are presented separately to the oversight body. So this requirement has been updated to reflect this change.

Additionally, asset owners may choose to create additional composites to present to the oversight body in a GIPS Asset Owner report. These composites must also be included on this list.

10. Verifier independence

The exposure draft proposed that compliant asset owners have a policy to ensure verifier independence; this was dropped. That said, asset owners must still “gain an understanding of the verifier’s policies for maintaining independence and must consider the verifier’s assessment of independence.”61

11. Secondary benchmarks

While it may not be common for asset owners to show a “primary” and “secondary” benchmark, it is allowed. With the 2020 version, the asset owner must report “all required information for all benchmarks presented”62 in the GIPS Asset Owner report (e.g., the 36-month ex post annualized standard deviation for both).

12. Benchmarks*

If the asset owner changes benchmarks, under the 2010 version they must disclose the date, description, and reason for the change.63 However, the 2020 edition has dropped the need to provide the reason.64

61 ¶ 21.A.28

62. ¶ 24.A.5

63 ¶ I.4.A.30 GIPS Standards 2010.

64 ¶ 24.C.26

If the asset owner uses a custom benchmark or a combination of multiple benchmarks, the asset owner must now disclose the calculation methodology and clearly label the benchmark to indicate it’s a custom benchmark.65

The Standards also address the use of a policy benchmark that is a blend of asset class benchmarks based on the policy weights for those respective asset classes, requiring asset owners to disclose:66

∙ The benchmarks used by each asset class along with their weights as of the most recent annual period end, and

∙ General information regarding the investments, structure, and/or characteristics of the benchmarks.

The Standards also speak to “portfolio-weighted custom benchmarks,” requiring asset owners to disclose:67

∙ That the benchmark is rebalanced using the weighted average returns of the benchmarks of all the portfolios included in the composite

∙ The frequency of rebalancing

∙ The components and their weights, as of the most recent annual period end

∙ That the components and weights of each component are available for prior periods upon request.

13. Some clarity on large external cash flows

Compliant asset owners are required to revalue portfolios for “large” external flows. This only applies to asset owners who use a monthly, day-weighted method. If you calculate returns daily, then you’re revaluing for all flows, so you might say that your definition of large is any cash flow greater than or less than (or, actually, equal to) zero.

A question occasionally arises as to whether asset owners can revalue in the case where the external flow is not “large.” The answer has always been “no.” And why is this? Well, because it becomes a risk that the asset owner will elect to also revalue when that revaluation results in a higher return. This would be a problem.

65 ¶ 24.C.27

66 ¶ 24.C.28

67 ¶ 24.C.29

Well, the 2020 Standards make this point quite clear: “For external cash flows that are not large cash flows, calculate total fund and portfolio returns that adjust for daily-weighted external cash flows, if daily returns are not calculated.”68

14. Preliminary, estimated values

If preliminary, estimated values are used to determine fair value, this must be disclosed.69

15. Subjective, unobservable inputs

Asset owners are required to include the percentage of subjective, unobservable inputs as of the most recent annual period end, if the asset owner has determined that they are material.70

16. Goodbye to composite assets as a % of firm assets

The 2010 edition requires asset owners to report “either total firm assets or composite assets as a percentage of total firm assets, as of each annual period end.”71 Thus, they had an option to pick one or the other.

The 2020 version has removed the option to report “percentage of total firm assets,” meaning that they must report total asset owner assets.

If you’ve been using the “%” option, you can show that through November 2020, but once you start reporting the calendar year-end (i.e., December) 2020 figures, you must convert. You can convert your history, which we think would make the most sense, or simply change going forward.

17. Change in claim of compliance wording*

Asset owners that have been verified must alter their wording:

“[Insert name of asset owner] claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. [Insert name of asset owner] has been independently verified for the periods [insert dates]. The verification report(s) is/are available upon request.”

68 ¶ 22.A.21.d.

69 ¶ 24.C.32

70 ¶ 24.A.2

71 ¶ I.5.A.1.h. GIPS 2010.

“An asset owner that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the asset owner’s policies and procedures related to total fund and composite maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on an asset owner-wide basis. Verification does not provide assurance on the accuracy of any specific performance report.”72

Likewise, asset owners that are both verified and have had composite examinations have new wording, as well:

“[Insert name of asset owner] claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. [Insert name of asset owner] has been independently verified for the periods [insert dates].”

“An asset owner that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the asset owner’s policies and procedures related to total fund and composite maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on an asset owner-wide basis. The [insert name of total fund or composite] has had a performance examination for the periods [insert dates]. The verification and performance examination reports are available upon request.”73

18. A slight change regarding currency*

“The asset owner must disclose or otherwise indicate the reporting currency.”74

This presumably will allow an asset owner to show “USD” or £ or € or US$ or similar notation, rather than specifying the currency. This is a bit of simplification.

72 ¶ 24.C.1.a.

73 ¶ 24.C.1.b.

74 ¶ 24.C.9

19. Estimated transaction cost disclosures*

If an asset owner uses estimated transaction costs, they must disclose:75

∙ That they were used

∙ The estimated transaction costs used76 and how they were determined.77

20. Sunset provisions*

The Standards have modified certain disclosures to allow asset owners to discontinue their reporting if it is no longer deemed relevant to interpret the track record.78

21. 36-month standard deviation disclosure change*

With the 2010 version, asset owners are required to disclose if the standard deviation isn’t shown because there weren’t 36 monthly returns.79 This did seem a bit silly in cases where it’s obvious from the reported information whether there were a sufficient number of years.

22. Real estate component returns*

Within the 2010 version of the Standards, component returns for real estate were required.80 For 2020, the requirement has been changed to a recommendation.81

23. Periodicity of benchmark returns

If the benchmark returns are calculated less frequently than monthly, this is required to be disclosed in the GIPS Asset Owner report.

24. Enhanced disclosure for internal risk measures

It is now a requirement to disclose the returns used in order to calculate the internal risk measure presented. This would also include any additional risk measures the asset owner decides to present.82

75 ¶ 24.C.15

76 We do not yet know what this means.

77 Hopefully you’ll reference “the Spaulding method.”

78 E.g., ¶ 24.C.16, ¶ 24.C.19

79 ¶ 4.A.33. GIPS Standards 2010.

80 ¶ 6.A.14. GIPS Standards 2010.

81 ¶ 24.B.10

82 ¶ 24.C.35

25. Real estate disclosure

If the asset owner directly owns real estate investments, the asset owner must disclose that:

∙ External valuations are obtained and the frequency with which they are obtained; or

∙ The asset owner relies on valuations from financial statement audits.83

26. Change in return type*

If the return type presented in the GIPS Asset Owner report changes, for example from a time-weighted return to a money-weighted return, this must be disclosed, including the date of the change.84

83 ¶ 24.C.36

84 ¶ 24.C.33

Want To Save This Guide For Later?

No problem! Just enter your email address and we'll send you the PDF of this guide for free.